“You’ve got to be passionate.”

John Wethey is an accomplished veteran in the surplus lines insurance industry. As the executive director of Surplus Lines Association of Colorado and the co professor of the Surplus Lines Insurance: Global Risk Management course, John is full of passion for his work.

In guiding newcomers to this industry, he looks for that same spark of passion in the next generation.

John’s Origin Story:

When people think insurance, they typically think of cars and houses, but John’s life in the Surplus Lines Industry boasts a little more glamour. His story is a tale of London, Leonardo DiCaprio’s breath and risking everything for a passion. His story is the sexy side of Risk Management and Insurance.

“When I was 18, I was studying science because all my friends were studying science. I had no aptitude at all for science and I was generally flunking out,” said John.

Back then, he had no clue what the future would hold for him. Neither did his mother.

“I was living at home and my mother got frustrated with me for doing nothing…she decided I needed to get a job, so she went to London, the closest big city, and arranged interviews,” said John.

Shortly after, John received his first job offer for a job at an insurance brokerage company, Mann Rutter & Collins.

The Sexy Side of RMI:

In John’s time working in risk management and insurance, he has had the opportunity to consider many unusual risks and develop insurance that would fit the exact needs of a risk manager. Being able to facilitate these policies requires one to be both broad minded and imaginative.

Before understanding how RMI can land young business professionals in such a stimulating career, it’s best to first understand what surplus lines insurance does for the economy.

Surplus lines insurance is a form of insurance that takes on risks ordinary banks and insurance firms would rather not handle. These policies can range from day-to-day circumstances such as new business ventures, to celebrities hoping to insure their career-crucial vocal cords or scenes in movies.

“Think about the cannabis industry,” said John. “In Colorado, Cannabis is a huge industry and unfortunately that industry couldn’t exist without surplus lines insurers .”

“Typical insurers refuse to insure cannabis…for one, it’s a class one drug and they don’t feel comfortable doing that since it’s against federal laws and they don’t want to break the law. Surplus lines insurers are willing to take that risk,” said John.

Large Risks and Large Rewards:

Surplus lines insurance specializes in providing coverage for unique challenges. That is exactly what happened with the filming of The Titanic.

In one of the final scenes, DiCaprio is drowning. His breath is hotter than the surrounding air and is beginning to vaporize. The directors decided to reshoot the costly scene.

“Logically the studio didn’t take him out to the middle of the ocean in the dead of winter because you don’t do that with your stars…we paid 5 million dollars to reshoot Leo’s breath,” said John.

John’s insurance company covered all the special effects including the boat and the water alongside DeCaprio’s breath. With that large risk came a larger reward. The Titanic became a 2.2 billion dollar movie.

John’s Advice for his Students:

While John was lucky enough to stumble into such a highly competitive industry, his advice for his students is not to follow in his own shoes.

“This industry is looking for people- looking for bright young people,” John says. “And in the United States there’s a heavy focus on having an undergraduate degree before you get a job.”

This is why CU Denver and the Surplus Lines Association of Colorado collaborated nine years ago. The goal was to put together a course on surplus lines insurance and find the next generation of industry professionals. It is a unique course co taught by Juengbo Shim, a CU professor, and John. This approach combines the excellence of the CU faculty with industry practice.

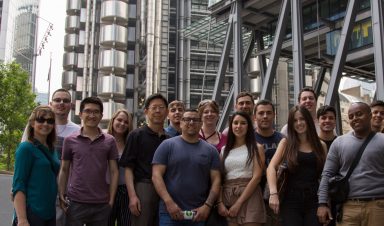

RMI in London: Global Risk Management is a unique international course for undergraduate and graduate business and risk management students. The course is designed to study how risk is transferred globally and provides an opportunity for students to travel to London for a week.

John believes the course is worth taking for any major.

“Once you’re in college you might as well expose yourself to as many things as you can,” said John. “

Afterall, without taking chances John may not be where he is today.

How to Find Success in RMI:

Thinking outside the box can really make all the difference in this industry.

“There are certain attributes that you have to have to be successful in this industry,” John said. “You must be someone who can think outside the box. There are a lot of situations you are asked to think about that aren’t traditional and you have to be able to devise solutions.”

Of course, this is exactly what makes RMI so appealing to young business students.

“It’s not a repetitive industry.” John said. “Every day is going to bring you a different challenge or something new.”

When asked if John has any regrets, his answer is an unequivocal no.

“There are a lot of jobs out there where people say there is no job satisfaction,” John said. “When I realized the difference I was making in people’s lives by allowing them to participate in the economy through transferring their risk – I found that very rewarding and stimulating.”

“The message I have for future RMI students’ is don’t focus on financial reward…instead focus on the intellectual reward,” John said. “Afterall, you’ve got to be passionate.”

Learn More about Risk Management Programs >